For many companies that already generate significant profits, the main difference between being taxed in France or in Andorra is not only the corporate tax rate, but how many times the same profit is taxed before it reaches the shareholder. This is where the Andorran model has become a very attractive alternative for companies and business owners.

Table of contents

Toggle1. Corporate Tax: two different philosophies

In Andorra, Corporate Tax has a general maximum rate of 10% on profits. The logic is simple: the company calculates its result, applies that 10% at most, and can use the remaining amount to reinvest or distribute it to shareholders.

In France, the system is clearly more burdensome. The general corporate tax rate is around 25%, with some nuances for small companies and certain brackets, but this is the usual framework for a growing company. With the same profit and loss account, the Andorran company starts with an advantage: it simply keeps more net profit after the first layer of tax.

2. The decisive moment: when profit becomes a dividend

The real difference appears when the company decides to distribute profits.

In Andorra, if the shareholder is an individual who is tax resident in the country and receives dividends from an Andorran company, those dividends are not taxed under their Personal Income Tax. The profit is taxed at company level and, when it “flows up” to the shareholder, it is not taxed again. The system is transparent and easy to understand: a single tax on the same profit.

Therefore, in France there is an effective double taxation close to 50%.

Requisitos para obtener la residencia fiscal en Andorra

Analizamos el concepto de residencia fiscal en Andorra: requisitos, documentación necesaria, ventajas fiscales. En Augé podemos ayudarte a conseguirla

3. A clear example: €1,000,000 of profit

If a company earns €1,000,000 of profit and decides to distribute it in full, the practical difference between the two models is very illustrative.

In Andorra, the company would pay 10% Corporate Tax, that is, €100,000. €900,000 of net profit would remain. If this amount is distributed as a dividend to an individual shareholder resident in Andorra, the shareholder receives the full €900,000, because those dividends are not taxed again.

In France, with the same million in profit, the company pays 25% Corporate Tax: €250,000. €750,000 remain available for distribution. When the shareholder receives that dividend, the 30% flat tax means an additional €225,000 in taxes.

The net amount that reaches the shareholder is reduced to €525,000. Same business, same profit before tax, but a radically different final outcome: in Andorra, the shareholder receives €900,000 net; in France, they are left with just €525,000. The combination of a lower corporate tax rate and the absence of taxation on dividends for the Andorran resident shareholder is what makes the difference.

4. Beyond the numbers: the relationship with the tax authorities

There is another factor that many business owners take into account: day-to-day dealings with the authorities.

In Andorra, the tax administration is smaller, there are fewer taxpayers, and the relationship is usually more direct. Without idealising the system, the general perception is that of a more stable environment, with less bureaucracy and a weaker feeling of “constant persecution”.

In France, the tax framework is perceived as heavier: more layers of taxation, more formal obligations, more audits and a strong culture of close supervision, especially for companies handling large volumes. For many executives, this translates into time, resources and energy diverted to tax management instead of focusing on business and growth.

¿Cómo trasladar una empresa a Andorra?

Descubre cómo trasladar tu empresa a Andorra paso a paso y crear aquí tu nueva vida familiar: requisitos, beneficios y trámites.

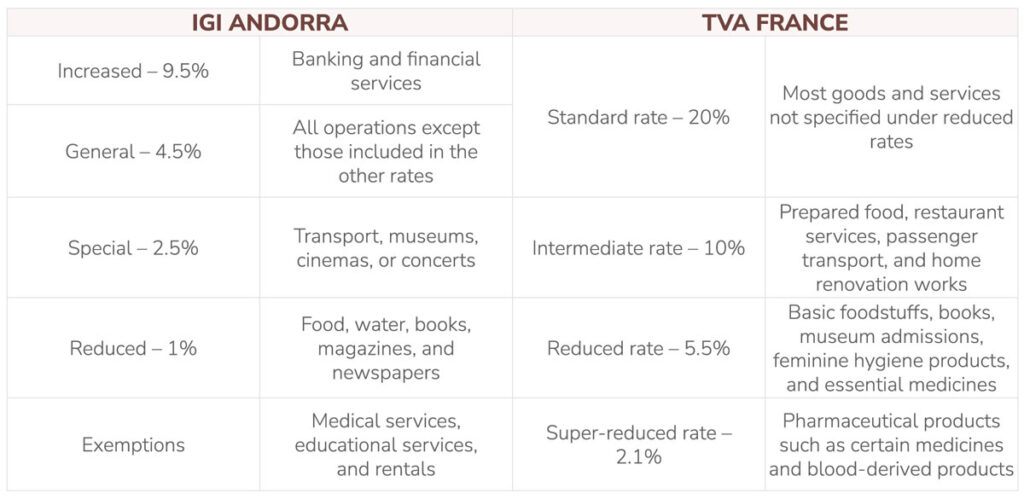

5. Andorra pays taxes… but not on dividends

The historical image of Andorra as a “tax haven” does not fit today’s reality. The country has Corporate Tax, Personal Income Tax and an indirect tax similar to VAT, and it is aligned with international transparency standards.

The difference does not lie in not paying, but in:

- paying less at company level,

- avoiding the same profit being taxed twice when it reaches the shareholder,

- and operating in a more predictable and less hostile environment for the company.

For this reason, for certain types of companies (especially service providers, holding companies or groups with real capacity to establish themselves and operate from the Principality), Andorra has become a strategic option: the company’s profit is not only generated, it is also preserved.