Blog

Here you’ll find information on taxes, residency, and the administrative procedures required to establish yourself in Andorra. We’ll also explore business creation and the latest trends in the real estate sector.

Omnibus Law 2 (Law 2/2026): continuity and consolidation of measures for sustainable growth: what changes and how it affects you

On 12 February 2026, Law 2/2026 of 22 January, on the continuity and consolidation of measures for sustainable growth, was published in the BOPA, entering

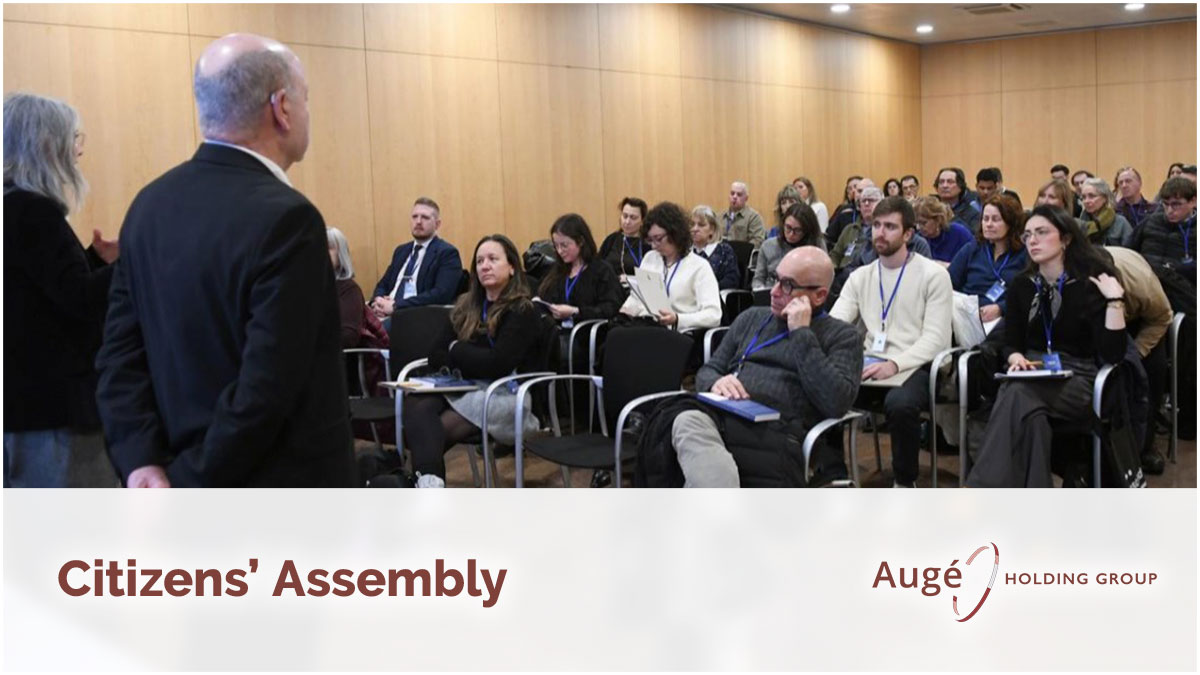

Citizens’ Assembly: empowerment and real democracy or participatory theatre?

A year ago, at Christmas, within our professional group we expressed a very specific wish for this 2025 that we have now left behind: that

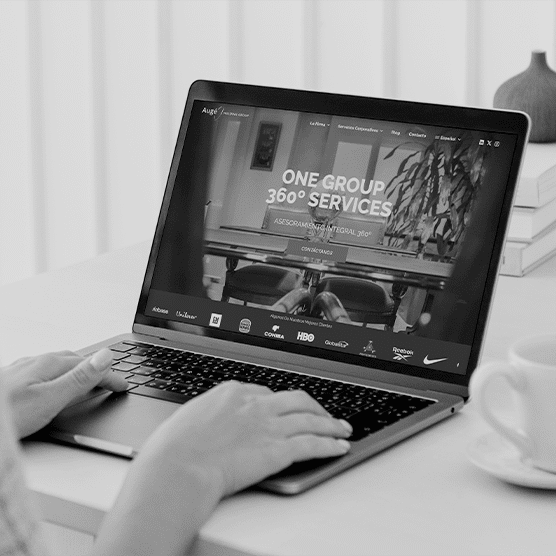

First year in Andorra: key documents for the tax residence certificate

When a client moves to Andorra, there is a simple but decisive step: deregistering in the country of origin and completing the registration in Andorra.

Omnibus Law 2 (Law 2/2026): continuity and consolidation of measures for sustainable growth: what changes and how it affects you

On 12 February 2026, Law 2/2026 of 22 January, on the continuity and consolidation of measures for sustainable growth, was published in the BOPA, entering

Citizens’ Assembly: empowerment and real democracy or participatory theatre?

A year ago, at Christmas, within our professional group we expressed a very specific wish for this 2025 that we have now left behind: that

First year in Andorra: key documents for the tax residence certificate

When a client moves to Andorra, there is a simple but decisive step: deregistering in the country of origin and completing the registration in Andorra.

Sign up for our newsletter.

Receive in your email the latest news, tips and exclusive content to be always up to date.

Featured categories

How to Create a Company in Andorra? Updated Complete Guide

Establishing a company in Andorra can be a very attractive option for entrepreneurs seeking a favourable tax environment and a high quality of life. However,

Omnibus Law 2 (Law 2/2026): continuity and consolidation of measures for sustainable growth: what changes and how it affects you

On 12 February 2026, Law 2/2026 of 22 January, on the continuity and consolidation of measures for sustainable growth, was published in the BOPA, entering

First year in Andorra: key documents for the tax residence certificate

When a client moves to Andorra, there is a simple but decisive step: deregistering in the country of origin and completing the registration in Andorra.

The Prohibition of Offering Financial Services in Andorra Without Being a Regulated Entity

Currently, Andorra is a growing financial market that attracts a wide range of investors and clients. However, to ensure the security and protection of clients,

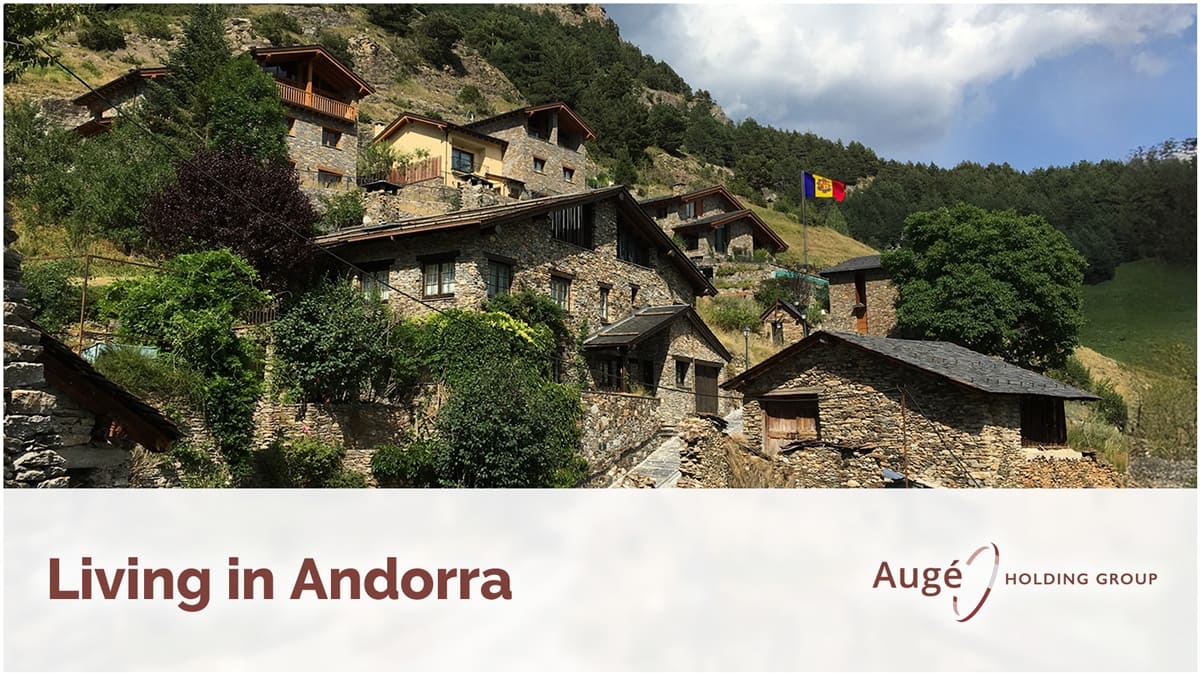

Requirements to live in Andorra: complete guide to moving to the principality

Andorra is a small principality located amidst the Pyrenees, between the borders of France and Spain. Its surface only covers 468km2, making it one of

How to obtain the Andorran nationality: requisites, procedures and benefits

Residing in Andorra is wonderful for many reasons, such as the country’s taxation, the quality of life it offers, the incomparable economic and business environment

Omnibus Law 2 (Law 2/2026): continuity and consolidation of measures for sustainable growth: what changes and how it affects you

On 12 February 2026, Law 2/2026 of 22 January, on the continuity and consolidation of measures for sustainable growth, was published in the BOPA, entering

Citizens’ Assembly: empowerment and real democracy or participatory theatre?

A year ago, at Christmas, within our professional group we expressed a very specific wish for this 2025 that we have now left behind: that

New Omnibus Law in Andorra: Key Changes in Foreign Investment and Housing

At Augé Holding Grup, we would like to inform you that on March 6th, the new Omnibus Law was approved in Andorra, introducing significant changes

Analysis of the regulatory changes of Law 3/2024, of February 1st, on the tax on foreign real estate investment in the Principality of Andorra

Analysis of the regulatory changes of Law 3/2024, of February 1st, on the tax on foreign real estate investment in the Principality of Andorra Undoubtedly,

Discrimination Arising with the New Law 3/2024, of February 1st, on Taxation of Foreign Real Estate Investment in the Principality of Andorra

Discrimination Arising with the New Law 3/2024, of February 1st, on Taxation of Foreign Real Estate Investment in the Principality of Andorra. To understand the

How and why to carry out a study of the real estate market

How and why to carry out a study of the real estate market. A market study is an analysis of information and data on properties,

Authors

Sr Pere Augé

CEO

Pau Augé

Chief Operating Offcier

Catarina Da Silva

Director | Augé Accountants

Jose Luis

Director Tax Lawyer & BC