Establishing a company in Andorra can be a very attractive option for entrepreneurs seeking a favourable tax environment and a high quality of life. However, the process of forming a company in the Principality may raise questions, particularly with regard to legal requirements, administrative procedures, and specific conditions for residents and non‑residents.

Whether you plan to move to Andorra or simply intend to open a company or invest in the principality, this guide explains the steps, requirements, costs, and key advantages for setting up a company or business in the Principality.

Table of contents

ToggleWhy choose Andorra to set up your company?

Setting up in Andorra offers interesting advantages, both from a professional perspective, focusing solely on business, as well as personal and family benefits, thanks to its climate, location, and quality of life.

The tax benefits stand out, especially: the general corporate tax rate for ordinary companies can reach 10%, one of the lowest rates in Europe; a limited personal income tax (IRPF); a 4.5% General Indirect Tax (IGI), equivalent to Spain’s VAT; and attractive exemptions on wealth, inheritance, and capital gains taxes, among others.

In addition, the Pyrenean country offers great political and economic stability, an incomparable natural environment, extensive fiber optic coverage, and efficient communication networks, all of which support business establishment.

Its strategic geographical location, between Spain and France, allows for numerous international agreements to avoid double taxation and offers very competitive office rental costs and other daily expenses compared to other countries in Europe.

It is also important to consider access for non-resident entrepreneurs: shareholders or managers may not live in Andorra, although there are specific requirements.

Do you already have a company and want to move it to Andorra? We’ll tell you how to do it here.

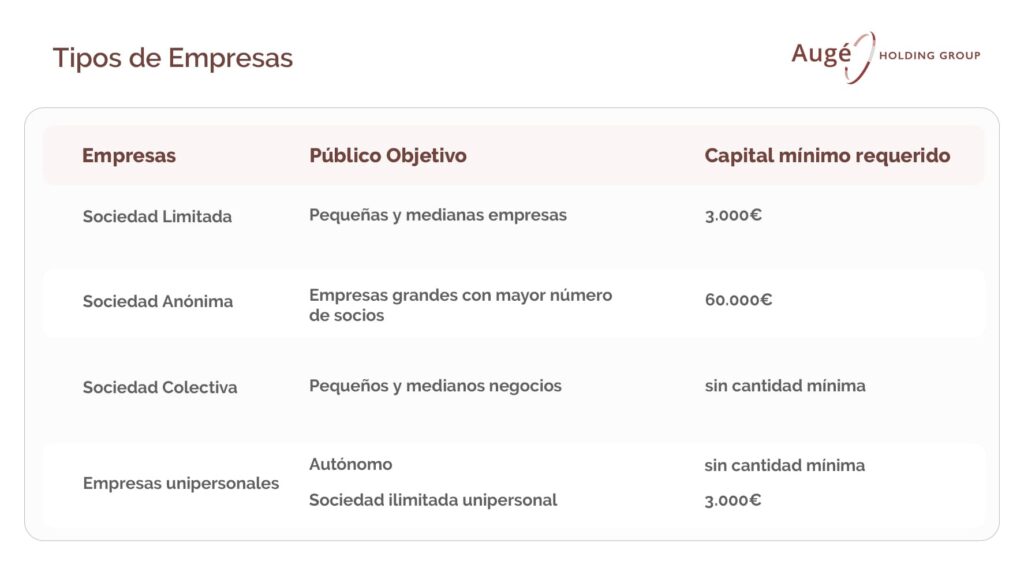

What types of companies can you set up in Andorra?

Before setting up a company in Andorra, it is important to decide on the type of company you want to establish. The first step is to determine the type of business you wish to create. The most common legal forms in Andorra are the Limited Liability Company, the Public Limited Company, the General Partnership, and Sole Proprietorships.

For example, if you choose to set up a limited liability company, a minimum capital of €3,000 is required, along with obtaining the foreign investment file. The entire incorporation process must be carried out before a Andorran notary. Afterwards, you will only need to obtain the company’s Tax Identification Number (NRT).

In addition, there are two considerations to keep in mind:

- To establish this type of company, a tax domicile in Andorra is mandatory.

- If the shareholders or managers are non-residents, foreign investment authorization may be required.

Limited Liability Company (LLC)

The most popular form for setting up small and medium-sized enterprises (SMEs). It requires a minimum capital of €3,000.

Public Limited Company (PLC)

It is more suitable for larger companies with a greater number of shareholders. The minimum capital required to establish a PLC is €60,000.

General Partnership

It is a very common structure for small and medium-sized businesses. The general partnership is not subject to a minimum capital requirement for its formation.

Sole Proprietorships

In Andorra, as in many other countries, sole proprietorships can be established under various legal forms, although the most common is the Single-Member Limited Liability Company (SLU).

- If you choose a Single-Member Limited Liability Company (SLU), the minimum capital for incorporation is €3,000.

- On the other hand, if you decide to operate as a sole trader, there is no mandatory minimum capital requirement.

How to set up a company in Andorra step by step.

Setting up a company in Andorra is a fairly straightforward process, but you should keep in mind that it involves a workload that can take between two to four months. This is because Andorra has a special procedure that requires certain steps to be completed before applying for company formation in the principality.

- Feasibility study: You must define the business purpose, the type of company, the estimated volume, and the location.

- Company name reservation with the Andorra Company Registry. It is recommended to propose up to three names in order of preference. The response may take up to 10 days.

- Deposit the minimum share capital according to the type of company.

- If you are a non-resident and will hold more than 10% of the shares, you will need to obtain foreign investment authorization. This requires submitting a complete file, and the process may take up to a month and a half.

- The next step is drafting the articles of association for the new company, where you must include the company’s business purpose, the address where the headquarters will be located, and the members of the board of directors.

- Signing before a notary and incorporation of the company.

- Registration with the Commercial Registry and obtaining the Tax Registration Number (

NRT). - Opening an Andorran bank account and depositing the share capital. This is the most challenging step, as you must pass the bank’s compliance process for the company. You will need to explain the SOF (source of funds) and the company’s activity.

- Deposits with the Andorran Financial Authority (AFA): These deposits are a form of guarantee or reserve that institutions must maintain with the AFA (Andorran Financial Authority) to ensure compliance with the country’s financial regulations.

- Registration with the Andorran Social Security (CASS) and, if necessary, obtaining specific licenses or permits depending on the business activity.

The process can take between 2 to 4 months, depending on the complexity of the case and whether the shareholders are residents or non-residents.

Additionally, depending on the type of business, it may be necessary to carry out some additional procedures, such as opening a commercial establishment, which is done directly at the relevant town hall or comú.

If you are looking to set up a holding company, we have a complete post with all the requirements and steps to do so.

We analyze the concept of tax residency in Andorra: requirements, necessary documentation, and tax advantages. At Augé, we can help you obtain it.

Leer artículoRequirements to consider:

Contrary to what some may think, setting up a company in Andorra is subject to strict international transparency standards, with a thorough review process that ensures the prevention of illegal activities such as money laundering. This requires gathering and presenting certain essential documentation:

- Criminal background check legalized with the Hague Apostille, generally valid for three months from the date of issuance.

- A copy of the passport, also legalized with the Hague Apostille.

- Documentation describing the entrepreneur’s professional profile and business model (e.g., resume, business plan, etc.).

- Proof of tax compliance, such as previous tax returns, as well as documents that verify the source of funds (accounting records, annual accounts, etc.).

Additionally, it is important to consider certain factors.

- There are formalities to be met: tax domicile in Andorra, even if the company is virtual, accounting, transparency, and source of funds.

- The bank will conduct rigorous due diligence processes, especially for non-residents.

- Although the tax regime is favorable, the structure must have real substance to avoid challenges regarding tax residency.

- The process may take time and should be carefully planned.

How much does it cost to set up a company in Andorra?

Setting up a company in Andorra is a relatively straightforward process, but it involves a series of initial costs and recurring expenses that should be considered before starting the project. These costs vary depending on the type of company you wish to establish, the economic activity to be developed, and other factors.

| Share Capital | From €3,000 (SL) or €60,000 (SA) |

| Notary and Legal Fees | Between €300 and €2,500 |

| Commercial and Industrial Registry | Between €200 and €400 |

| Bank Account Opening | Between €0 and €200 (additional annual maintenance fees) |

| Business License | Between €100 and €1,000, depending on the type of business |

| Tax and Accounting Advisory | Between €300 and €1,000 monthly |

| CASS Registration | Monthly contributions of 22% on gross salary |

Las contribuciones mensuales son del 22% sobre el salario bruto.

Can I set up a company in Andorra and live in Spain?

Yes, it is completely possible to set up a company in Andorra and operate in Spain without the need to reside in Andorra. No law prohibits it.

However, concepts such as effective management or economic substance (i.e., where the offices, employees, and key activities of the company are located) are crucial in determining the tax residency of the company.

Although the company you establish may be incorporated in Andorra, it is important to note that the tax authorities in your home country could consider the company to also be a resident there if they can demonstrate that the effective management is carried out in that country.

For example, even if a company is set up in Andorra, if Spain can prove that the management and main operations are carried out from its territory, the company will have to comply with the Spanish Corporate Tax.

How to manage operations in Spain and Andorra?

Managing operations between Spain and Andorra requires a strategic approach that takes into account the fiscal, legal, and operational differences between the two countries. Although they share a close geographical relationship and certain economic ties, their regulatory frameworks and business systems are distinct.

To avoid issues when setting up your company in Andorra, you must fully understand the fiscal, labor, and operational differences between both countries.

Double Taxation Agreement

The Double Taxation Agreement between Spain and Andorra is a bilateral agreement aimed at preventing taxpayers from paying equivalent taxes on the same income in both territories. This type of agreement is crucial for facilitating economic and commercial relations between countries and, in this case, provides a framework that allows taxpayers to avoid double taxation and optimize their tax burden in both countries.

Worker and Business Mobility

The mobility of workers and businesses to Andorra is smooth due to the geographical proximity and cooperation between the two countries. Although Andorra is not part of the European Union, there are mechanisms that allow people and businesses to operate and move between both countries relatively smoothly, with certain legal requirements and considerations to take into account.

Workers moving to Andorra to work must apply for a work and residence permit, while businesses must establish a company in the country.

The regulations governing bilateral transactions

Bilateral transactions between Spain and Andorra are regulated by a series of regulations and agreements that cover various areas, such as trade, taxation, the financial system, and labor mobility. Although Andorra is not a member of the European Union, it maintains a close relationship with Spain and other European countries through specific agreements and its association agreement with the EU.

Augé Legal & Fiscal